“The biggest room in the world is the room for improvement.” – Helmut Schmid

How do you justify the expense and time of making changes to their businesses, especially if you decide to hire a coach?

While we can identify real benefits, my many years of experience say justification is a state of mind. Humans are driven by feelings. Studies conclude that up to 90 percent of our decisions are based on emotion. We use logic to justify our actions to ourselves and to others. Emotion is what really drives decision making. You must believe you need to make business improvements and want to make them.

Perhaps the biggest benefit of making changes to your practice is difficult to measure. In financial advisory practices, most FAs tend to work individually, even if part of a team. As part of a team, advisors can at times work with a partner to bounce ideas off one another. With solopreneurs it’s more difficult. There is a great benefit for advisors to share ideas with another individual to:

- See if plans make sense from another perspective.

- Find out what other advisors are doing in similar situations.

- Brainstorm new ideas and consider other options.

- Share confidentially.

When a coach is your partner you have an informed, knowledgeable teammate; an independent voice who cares as much about your business as you do. The difference between success and failure is often small. That gap can be narrowed with a business coach.

Statistically accurate metrics on the growth of assets and revenue over a significant period for multiple advisors are limited. One article said, “The Oechsli Institute claims that the average coaching client brought in over $19 million in assets over the past 12 months, added 21 new clients and increased advisory fees by nearly 22 percent.” It is difficult to evaluate specific benefits without knowing the situation, including the baseline in these cases.

In another article, Oechsli’s research showed that “advisors who are consistently acquiring wealthy clients are a distinct minority, and most other advisors are eager to learn how to replicate that success.”

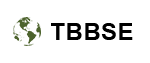

We can point to cases in our own experience where FAs have increased production by 50 percent in little more than three years while they also grew AUM by 83 percent. However, one of the reasons it is difficult to suggest an anticipated increase in growth rates is because it depends on many variables: the advisor, the markets, the length of service of the advisor, the client base, and mostly the depth of execution the advisor puts into implementing the recommended processes and changes. While case studies are available, they are usually one-offs and don’t represent statistically accurate assessments.

Most of the literature states benefits in the form of qualitative improvements. We have no doubt, though, that you will grow your assets, revenues, and client households, and have an excellent ROI in doing so, if you:

- Formally segment and analyze your book and clients.

- Develop a realistic and complete business plan.

- Implement the “Six Core Client Facing Processes”.

- Effectively execute several business development approaches.

- Track your actions and results.

- Clearly define and state the value you deliver.

You will also be more efficient, effective, and consistent in what you do and how you do it. You will have the time to implement an effective set of marketing and sales approaches for improved client acquisition efforts. You will be less overwhelmed, less stressed, and have a more manageable practice. You will maintain or improve your client retention.

Overall, effective implementation of the contents of “The Financial Advisor’s Success Manual” will provide:

- More structure around what you do, when you do it, who you do it for, and how you do it.

- A focus on what is important to you.

- Ideas on what is working for others.

- An opportunity to be held accountable if you implement these processes with a capable, experienced accountability partner. On a scale of 1 to 10 (10 being high), you need a laser focus to be at a 9.5 or better. That’s where accountability comes in.

- A better understanding of your unique areas of opportunity.

- A clear roadmap of how to take your business to the “next level.”

- An increase in client loyalty.

- Deeper and more profitable relationships.

While there is data to support the benefits of coaching for the implementation of financial advisory practice improvements, and while we believe those benefits can be achieved, at the end of the day, the only important belief is yours, as the advisor. Do you believe your business needs change and you will benefit from those changes?

David I. Leo, The Benefits of Implementation Snippet 21

David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients.

If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com

My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136.

Use These Seven Marketing and Sales Approaches To Effectively Develop Your Business

6/20/2030

“Sales is an outcome, not a goal. It’s a function of doing numerous things right, starting from the moment you target a potential prospect until you finalize the deal.” – Jill Konrat

A solo advisor can only undertake so many efforts. Those efforts should focus on introductions from clients and professional alliances, LinkedIn, and possibly your “Book of Life.”

As a member of a team you may be able to use other approaches by sharing the marketing workload so you can do some strategic networking, undertake more “intimate events”, conduct targeted roundtables, have a drip program, speak at public forums, and/or develop and manage client advisory boards. All these efforts can help in business development.

Additional resources we recommend:

- Millennial marketing. Keep managing the money of your best clients once it is passed to the next generation. Read on at https://www.coachdavidleo.com/articles/millennial-marketing-why-its-vital-and-how-to-shape-it

- Strategic networking. Financial advisors need to get involved in organizations within the community that attract those with high net worth. Develop and maintain quality relationships that may enrich your life and help you achieve your goals. Give first and learn from everyone that you meet. An excellent book we recommend is Million Dollar Networking by Andrea Nierenberg (Herndon, VA: Capital Books, 2005).

- Intimate client events. These are small gatherings to which clients are encouraged to bring friends, and where the overt purpose is solely social, not business focused.

- Targeted roundtables. These private events tend to focus on a group of people that one or more of your clients may be part of. Using a “Client Wisdom worksheet” you can identify companies your client works for where you can offer a “lunch and learn” event or an after-work event. You can also conduct roundtables if your client is part of a social group.

- Drip programs. Extensively used and worthwhile, drip programs keep your name in front of prospects. It’s rare that advisors will acquire clients from these mailings, so follow-up phone calls are required where you can ask about people’s interest in the material you are sending or if they would prefer different material. See our article “Content May Not Be King” at https://www.coachdavidleo.com/articles/content-may-not-be-king

- Speaking at public forums on a range of corporate compliance-approved topics. Speaking engagements are another way of getting recognition of what you do and how you do it. Your internal marketing areas may provide prepared presentations on a host of subjects.

- Client advisory boards. Sitting on the board are top clients and members of your team tasked with giving you feedback on services, marketing, and other aspects of your business and potentially sharing ideas on how you can grow your business. Client advisory boards can be powerful tools for building relationships with top clients, capturing detailed client feedback, and growing business.

David I. Leo, Additional Marketing and Sales Approaches Snippet 20

David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients.

If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com

My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136.

Higher Profitability with Niche Marketing

6/19/2030

“Choose the niche that you enjoy, where you can excel and stand a chance of becoming an acknowledged leader.” ~ Richard Koch

Niche marketing is more of a context for marketing, rather than a marketing approach. Niches represent a specific pool of individuals who are targetable prospects. These individuals tend to share similar challenges often unique to the group; they represent a business opportunity and should complement your strengths and personal interests. Examples of niches with these characteristics are general dentists and general medical practitioners (e.g., GPs or internists).

These professions tend to be tied to a chair or examination room and have appointments back to back in many cases. Medical and dental insurance puts stresses on incomes resulting in high and/or growing patient loads. These niches represent a business opportunity because their income is well above average. It would be helpful for advisors to have the experience of having worked in the field or to have clients already in these fields so that they can understand their pain points and concerns.

Niches generally respond predictably to marketing activities and financial solutions. Many advisors have targeted physicians. However, physicians can be challenging because of their self-confidence. They are also a challenge to get time from, yet they have been sought after.

Niches must be narrowly defined (e.g., not doctors, but anesthesiologists or gastroenterologists or radiologists). Individuals in narrowly defined fields:

- Tend to share a common culture

- Share affinities

- Read the same professional journals

- Attend the same meetings or conferences

- Have more of a tendency to know others in their sphere

Niches need to be active communicators and be affordably accessible.

Women are not a niche, retirees and pre-retirees are not niches. The commonality among women, retirees, and pre-retirees is not there. There is no single common culture, no common way to access them, and there is no shared affinity as a larger group. If, however, you narrow the focus to women executives in your geography . . . or to IBM employees retiring from New York or Austin, Texas . . . or, for that matter, to women retiring from IBM in New York City, you have defined niches.

Seek Introductions Within Your Niche

In some cases, COIs specialize in the same niches in which you may be interested, so you can use your COI marketing strategy with them. You can focus your LinkedIn searches on specific professions or organizations.

If you hold intimate events, you can invite a client to dinner and ask her to bring one of her friends in that same niche. Putting people into groups can create a feeling of proprietorship and relationship with that group. This feeling is an important element to your business development efforts. It can make you feel a level of comfort and confidence as you move forward. You have made an investment in the group and the individuals in that group.

Invest in a Niche

Prepare yourself to work with that group by:

- Reading about the group in publications they may be reading,

- Understanding their demographics and psychographics,

- Interviewing group members and COIs who work with them,

- Joining their organizations, and

- Networking with them.

In addition, identifying group members who may be prospects and researching them will also prepare you for marketing to the group and individuals within the group.

Profitability from niche marketing can be higher because:

- Marketing costs are lowered,

- The prospecting is easier,

- The pipeline is larger,

- The closing rate is higher and quicker because of natural trusted relationships, and

- The referral flow is better because of word-of-mouth.

Commonality within your marketplace makes you the master of the trade and enables you to spend your time better and be more focused. However, for a niche to be productive, it must generally have at least 200 to 300 prospects in your access area that are well-to-do and well positioned from an income perspective. Most important, you should have a level of comfort in working with the selected targets.

Getting Started With A Niche

- Select two or three niches that fit your business, that you like, and where you have an “entry point” via contacts and/or knowledge to leverage practitioners or employees (e.g., law firms, medical/dental practices, firms you have previously worked for)

- Read about the group in publications, understand their demographics and psychographics

- Interview group members and COIs who work with them

- Join their organizations

- Network with them

- Identify group members who may be prospects and research them

From a marketing perspective, niche marketing allows the advisor to become an expert in how to reach prospects in the niche rather than relying on a more helter-skelter, one-off approach to finding prospective clients. It also allows you to develop a marketing plan tailored to that niche based on in-depth knowledge of the niche’s wants and needs. A custom-designed approach enables you to leverage your marketing efforts to reach prospective clients in that niche.

From a planning perspective, niche specialists leverage their time and solutions by offering the specific financial needs of the niche, so you become an expert in the financial products or services to meet them. You do not need to know everything about all the solutions the business offers but need to know well how to meet the needs of the niche.

Since niche members tend to know each other and interact, the goal is when their talk turns to investing, your name comes up as the expert and the “broker of record” in the selected niche.

David I. Leo, Niche Marketing for Client Acquisition Snippet 19

David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients.

If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com

My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136.

Develop Your Potential Prospect List with a Book of Life for Client Acquisition

6/18/2030

“True networking does not mean meeting people; it means becoming the type of person other people want to meet.” ― Monroe Mann

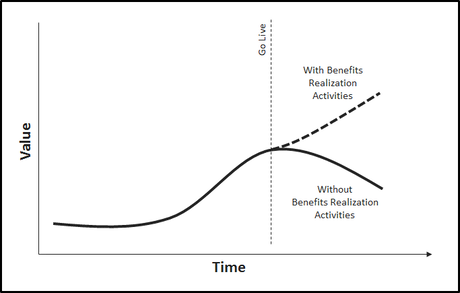

The intent of marketing is to begin to get people to know, like, and trust you. For people we know and have met but don’t necessarily have a recent or deep relationship with, we use similar marketing methods to move towards a business relationship and seek an initial business meeting, so they become a “prospect”. Many advisors, especially when they were new to the business, have put together a list of all the people they know or have known for the purpose of creating a potential prospect list.

Your marketing program should convey:

- What you do,

- How you do it,

- How you deliver it, and

- The value you deliver

The purpose is to create a situation where these individuals get to know, like and trust you. Marketing, at its core, is communication. And, you communicate through the words you use.

Your “Book of Life” is focused on who you know or knew throughout your life. List what you know about them. This can be made easier by thinking in categories.

Your “Book of Life” can include at least categories such as:

- Family, friends, and neighbors

- Clubs and organizations to which you belong

- Executives and key persons at previous places you worked

- The clients, supporters, and suppliers you met affiliated with that firm

- Small businesses in your geography

- Health care practices you know and/or use

- Employees affected by layoffs

- Hobbies and life interests

- Sports in which you are involved with others

- Parents of your children’s friends

- People you have met on various occasions in your role as a financial advisor

- People associated with specific companies that are creating wealth

- People who are part of your client social network

The purpose of this exercise is to record everyone the advisor knows, formally, in writing. This forms the basis of your potential prospect list.

Develop your potential prospect list with these “Rules” for Your “Book of Life”

- If you know the person’s contact information, age, or their interests or where they work or what they do, record what you know

- If you do not know much about the person leave it blank with just the name and how you know them. The missing information can be researched later if necessary.

- Do not cull names while developing the list. Don’t “assume” anything about the person’s financial situation or their potential interest. Just post names and whatever you know about the person.

- The person may or may not be client-worthy, but they may know people who are client-worthy.

- The best contact approaches for these potential prospects are white papers, emails, events, and the telephone.

- Your first step with your “Book of Life” list is to contact the person.

- At some point you have hopefully “earned the right” to move towards a business relationship and seek an initial business meeting.

- Our suggestion is to target 250 people for your “Book of Life”.

Even though Dunbar’s number suggests that humans can only comfortably maintain 150 stable relationships, theoretically, the average American may know as many as about 600 people. In addition, according to Funders and Founders, individuals may interact with as many as 80,000 people in a lifetime.

Advisors may have explored this area previously but may have not been formal or methodical about it. Not everyone on your list will become a client, but they may be able to refer you to someone who will be.

David I. Leo, Your Book of Life for Client Acquisition Snippet 18

David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients.

If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com

My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136.

Your Center of Influence (COI) Marketing Strategy

6/17/2030

“The more you talk about them, the more important they will feel. The more you listen to them, the more important you will make them feel.” ― Roy T. Bennet

Grow your business by marketing around key people and organizations who can boost your market access and credibility through referrals, testimonials, and word-of-mouth.

COIs are people who work with people who are like your ideal clients. Consider: what services do many of your best clients often need? As a financial advisor, the answer certainly includes CPAs, attorneys, mortgage professionals, and trust underwriters as well as trades people, family law attorneys, some auto dealers, bookkeepers, travel companies, and others.

Expand your network to tap into the network of other professionals.

A clean, fair, intriguing approach is to educate 100 other professionals on exactly what you do and ask them to educate you on exactly what they do. Why? Because professionals know and come in contact with lots of other people, some of whom are perfect to be your clients. Vet these professionals to ensure the quality of your network. You don’t want a plumber who always causes a backup or an electrician who causes fires. I would limit your COIs to the 10 to 15 of the most important skills your clients may need. If you have a large enough team, you can expand the list.

Many advisors find it challenging to develop relationships particularly with CPAs and attorneys. These professionals don’t want to risk you negatively impacting their relationships. Know, Like, and Trust are still the key drivers along with the high-value and quality expertise they provide. Social relationships are also important.

Limit the number of “strategic relationships” you have with the CPAs and attorneys you work with to a total of only 4 or 5. You cannot likely effectively support more. Nevertheless, you should know of most of your clients CPAs and attorneys and they should know of you.

A “strategic relationship” is one with a professional that:

- Offers high quality, high value, expertise in the areas of greatest needs of your clients along with high-service

- Is cost competitive

- You have a good personal relationship with

- You have continuing, regular and on-going communications with

- Has similar criteria for clients as you do. They are a good fit. They are good to work. They value the services provided.

- Has a structured approach to solving client problems and fulfilling their needs

- Is an effective communicator

- Most importantly, considers you a “strategic relationship” which includes a joint introduction commitment, i.e., the relationship adds value to both businesses

The right COIs provide testimonials (at least for your brag book), information (to increase your knowledge), contacts, introductions, presentation support, themselves as clients, promotion, resources, skills, and clients.

Here are 6 steps to develop strategic relationships that can grow your business:

1. Identify potential COI partners

2. Vet potential COIs with your clients

3. Make an initial call to COI and ask two key questions to continue:

o Are you taking on new clients?

o Do you already have a trusted financial advisor to whom you refer your clients?

4. Have an initial meeting with the COI

5. Have the COI visit your office to meet your people, discuss your processes and see your technology and facilities

6. Plan the next steps with the COI

Final points of advice:

- Do all the things you do with your BEST clients and move it over to the attorneys and accountants who are your “strategic partners.”

- You do not need a lot of partners to enhance your business. One study showed the average number of partners for an elite group of FAs was 3.9.

- Take the approach, “What can I do for you?”; NEVER, “Let me tell you about me.”

- Track all components of your “strategic” professional relationships.

- Consider a free client service for your “strategic partners”, e.g., your discovery process.

David I. Leo, Your Center of Influence Marketing Strategy Snippet 17

David Leo is Founder of Street Smart Research Group LLC. He is an author, speaker, coach, consultant, and trainer to financial professionals. David is an experienced business manager who works solely with Financial Advisors, Planners and firms who want to organize, structure & grow their businesses by attracting, servicing, and retaining affluent clients.

If you have questions or would like assistance in personalizing and implementing approaches from The Financial Advisor’s Success Manual, schedule a free 45 Minute Strategy Session at https://calendly.com/davidileo or contact me at David@CoachDavidLeo.com or visit my website at www.CoachDavidLeo.com

My book is available at Amazon at https://www.amazon.com/Financial-Advisors-Success-Manual-Structure/dp/0814439136.